Think about your favorite digital bookstore, your checking account’s mobile app or your go-to weather widget. All of these systems operate on mathematical models called algorithms. With every click and tap you make, these algorithms make thousands of micro-decisions that instantly serve up the information you want. At a futures exchange, algorithms like these play a vital role in the trading and clearing process.

Algorithms: the building blocks of trade exchange

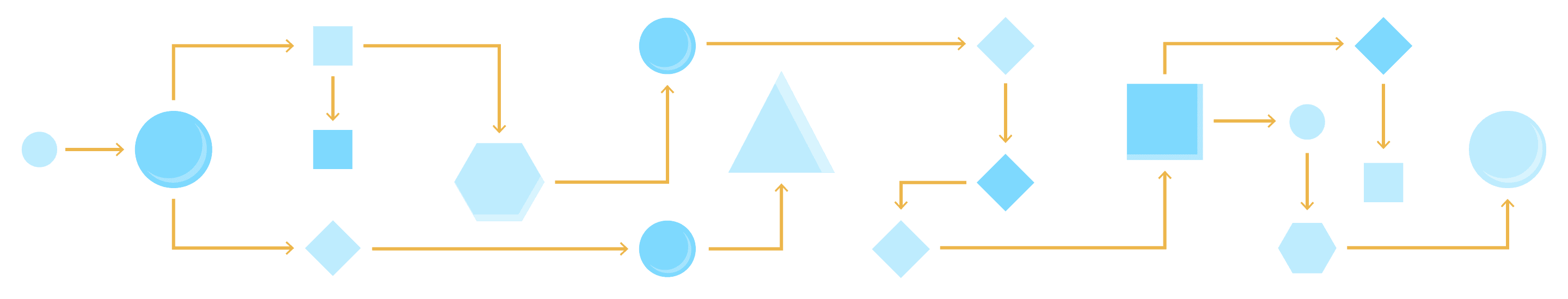

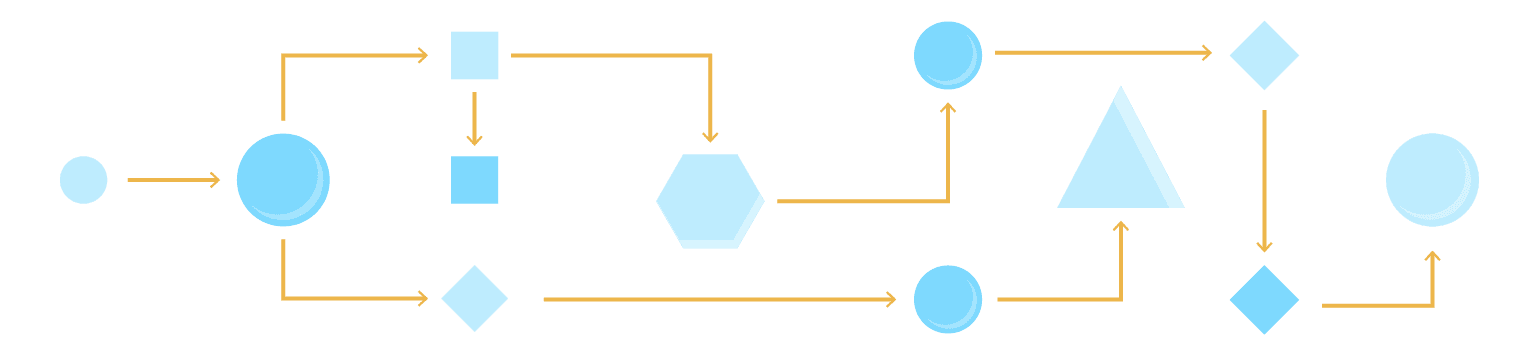

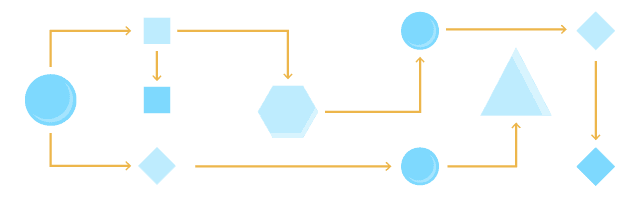

An algorithm is like a recipe for a meal: a set of step-by-step instructions for achieving a specific outcome. When it comes to trading futures, different kinds of algorithms give traders different options for executing their orders. These options can be common, run-of-the-mill order types that are supported by the exchange, or they can be customized algorithms designed to meet a range of unique trading needs.

An example: the Time Weighted Average Price (TWAP) algorithm

Every day, institutional traders buy and sell large numbers of futures contracts through the exchange. If they were to make each of these large trades in one fell swoop, the resulting price swings would influence the baseline market price and increase volatility and price risk among all market participants.

A TWAP algorithm allows traders to break their trades into multiple small orders. The algorithm uses its own complex set of rules to determine the best time to buy or sell, while having the least impact on the market. By spreading out these trades strategically over time, the TWAP algorithm helps the markets maintain a stable amount of liquidity.